As I write this, we are approaching the 2025 Federal election day with cost of living, and housing among the hot-button issues of this year’s campaign.

Australia fortunately enjoys a more stable political environment than other countries. While election seasons typically cause property market activity to slow, the election outcome has historically proved to have little immediate impact on real estate values regardless of which party forms government.

Housing and cost of living dominate public discussion for good reason and their influence on property market activity is undeniable. More recently, for example, we’ve seen a substantive move by tenants, keen to break free from our nation’s tight rental markets, exploring home ownership options. Unfortunately for first-time buyers, prices remain relatively high at a time when managing household budgets is challenging. Housing affordability currently sits at approximately seven to eight times the median income– well above the historic three to four times multiple experienced a few decades ago. The time required to save a 20% deposit on a median-priced house has also risen to around 10 to 12 years, again well in excess of the four-to-six year measure from the 1980s and 1990s.

On the positive side, a downward trend in interest rates can deliver greater buying power to purchasers. That said, serviceability is a key factor in being approved for a loan, and many young buyers will still struggle to secure funds without assistance from family.

Buyers are increasingly needing to compromise their priorities and making sacrifices to secure a home.

Of course, the one element we’re taught never to concede on is location. It’s a foundational tenet of smart buying.

With this in mind, we asked our valuers an important question this month – how do you secure property in highly desirable locations at reasonable prices?

The answer is that if location is the non-negotiable, then you must look elsewhere for conciliations.

Whether it’s property size, quality, type, or a range of other attributes, there are various strategies that can help buyers on tight budgets secure homes in high-quality locations.

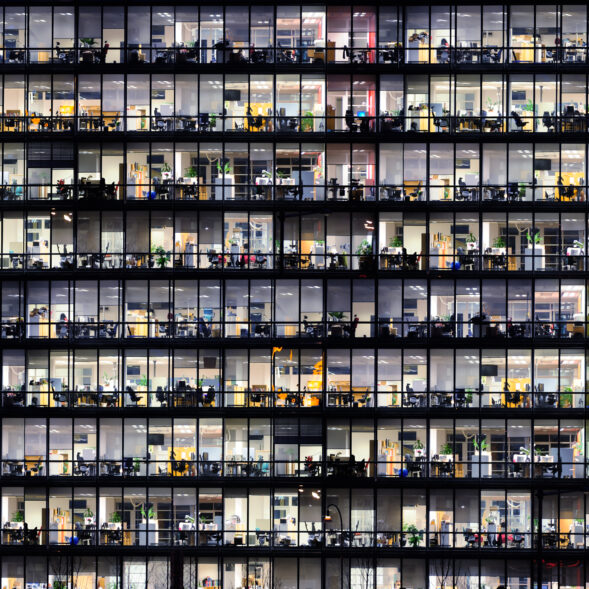

On the commercial front, our teams have discussed the industrial property market and provided localised outlooks for key markets around Australia. Perhaps the most common thread among these submissions is that while industrial remains the most widely successful sector across the commercial space, activity is cooling. In several locations, prices have reached their peak, and investors are becoming more circumspect about what they choose to purchase.

In this month’s rural section, our specialists provide an in-depth examination of Australia’s grain industry. Their submissions detail current trends in this essential agricultural sector and discuss the critical elements that will shape its direction throughout the remainder of 2025.

These insights highlight why local expertise is invaluable when considering property investments. As markets continue to evolve and adapt, accessing professional, unbiased guidance becomes increasingly important – a cornerstone service that Herron Todd White continues to deliver.