Welcome to the December edition of Month in Review

In 2024, resilience and divergence have played major roles across property markets and business operations.

Property price performance and sales activity were fairly consistent across many of Australia’s real estate markets from 2020 and 2023. However, we are now firmly in our post-pandemic phase and the past 12 months have seen a substantial divergence in market trends between various locations.Our two largest capital city markets have certainly slowed – particularly Melbourne. The city has experienced a prolonged period of softening prices, and Melbourne has now fallen from third to sixth on the nation’s capital city median house value rankings. In stark contrast Brisbane, Adelaide and Perth have seen exceptional value gains this year. Perth experienced an astonishing house median value gain of 21 per cent in the past 12 months. Our regional centres saw mixed results too. Those with multiple economic bases and appealing lifestyle component faired best, but many regions which surged during the pandemic have seen home prices attenuate.

While there have been many significant national and global market drivers this year, the one mentioned almost universally by our contributors was the lack of interest rate movement. Predictions of a pending interest rate cut at the beginning of 2024 had stakeholders primed for a reaction in the market. Many believed an inevitable fall in rates would trigger a surge in pricing and sales activity.

But stubbornly high inflation kept the RBA’s decision on hold. Now, as we approach the end of the year, some forecasters are even suggesting rate cuts will be pushed back to end of 2025. The RBA’s decision to hold in 2024 has seen a material cooling, particularly at price points where buyers are most reliant on borrowing.All of this has me thinking about the importance of having a long-term vision in property. Historically, those who look beyond the markets short- and medium-term shifts tend to have the most success.

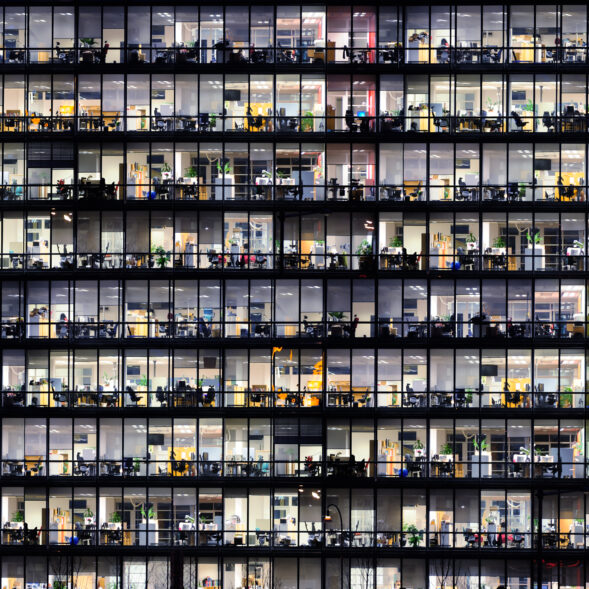

It’s a parallel that can be drawn to our business as well. A group of directors recently visited the birthplace of our organisation – Kerry Herron’s modest suburban home in Rockhampton where he began his valuation practice in 1969. Fast forward five and half decades, and Herron Todd White has grown to 800 employees across 63 offices. We deliver a wide range of property services across all sectors, with national coverage that’s second to none.

The long view has certainly served us and our clients well, and we are looking forward to many more decades leading the industry.

My sincere thanks to our clients who continue to support us, our staff who set an exceptional benchmark for service and to our readers for their ongoing engagement. May you and your families enjoy a safe, joyous and memorable season, and we look forward to seeing you all again in 2025.

Gary Brinkworth

CEO