Welcome to the June edition of Month in Review

The RBA last announced an increase to the cash rate approximately six months ago, marking a total increase of 4.25 per cent from March 2022 to December 2023.

That very first rate hike in 2022 had an impact on buyer confidence with many property professionals reporting an immediate slowdown in enquiry and transaction numbers. As the year progressed, we read reports about the possibility of severe turbulence in markets as borrowers moved from low-interest fixed rate loans back to more expensive variable products. The warning back then appeared dire for property stakeholders.

Surprisingly for some, this era instead illustrated the resilience of the Australian residential real estate market. Despite the uncertainty of 2020 to 2023, property prices increased while supplies tightened. These value gains have continued in 2024, although some of our valuers have noted a slowdown in recent months more reflective of a steadying than a fall.

During moments of sudden change, property stakeholders have proven reactive in the short term. When rates move, elections are announced, or dramatic events unfold, most buyers and sellers pause to take stock and wait for certainty.

But it’s a different landscape right now, and we appear to be at a seminal point in the cycle. The totality of interest rate rises has had time to filter through to buyer sentiment and we currently sit in a moment of relative “normalcy” for the drivers that compel property market activity.

While the most recent meeting of the Reserve hints that increasing interest rates could again be on the agenda to address stubbornly high inflation, most realistic commentators believe rate cuts will come either later this year or in 2025. All things considered, that means steady conditions for the next six months or so.

What we’re seeing now is a market returning to its long-term norms. Buyers remain eager but measured and well-informed sellers are probably recalibrating their expectations a little. The result should be an uptick in listings and transaction numbers as 2024 progresses. In fact, for some cashed-up buyers there could be opportunities in certain market sectors. I imagine once those predicted rate cuts do arrive, there may well be a flurry of activity that drives values higher once more. Those who act now will likely be the beneficiaries.

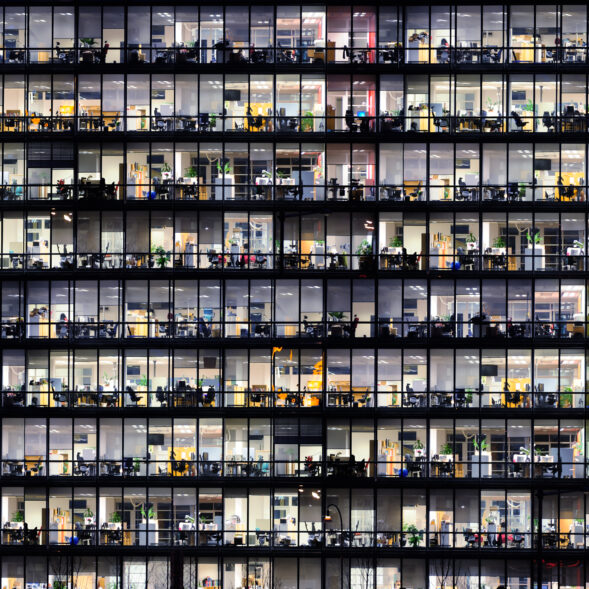

The same considerations can be extended to certain commercial sectors as well. Industrial property has been a high-performance asset class throughout the past few years. Increased online trading and the growing need for warehousing close to population hubs contributed to value growth and rising rents in industrial. According to our specialists, it’s a story that continues. While the rate of capital growth has attenuated somewhat, it remains positive – particularly for well-located, good quality assets.

In this month’s issue we also discuss a breakout sector in rural. Carbon farming is an emerging path for producers to generate income, particularly in holdings that were once considered their least productive. Rural directors John Gunthorpe and Bart Bowen provide a comprehensive rundown on this emerging rural option.

Please enjoy this month’s issue of Month in Review.

Gary Brinkworth

CEO