Welcome to the February edition of Month in Review

Welcome everyone to our first edition of Month In Review for 2024.

The first months of each year are an opportunity to contemplate what’s to come, and conclusions are inevitably reached through the lens of what occurred during the preceding 12-month period.

Significant, and sometimes unexpected, changes were the hallmarks of 2023. Interest rate movements were undoubtably the headline, with many commentators speculating that rising rates combined with the weight of borrowers moving from low fixed-interest rates to higher variable rates would be a catalyst for a mass sell down. It was expected that an increase in listings combined with reduced borrowing capacity among buyers would drive down values.

But this perspective proved too narrow. The basic value principle of supply vs. demand came to pass. We simply had too few housing options to meet the needs of a rising population base, so values increased across most major centres. Our five largest capital cities saw house prices increase by anywhere between three and 15 per cent during the year.

The good news for property owners is that this growth trend looks set to continue in 2024, although most probably at a steadier pace. The reason is current metrics point toward continued low supply and high demand.

The cycle of interest rate rises is either at (or extremely near) its end – the rate hold by the RBA on 7th February shows this new iteration of the Reserve is taking a more cautious approach to easing inflation. With rates on hold – or even potentially dropping – expect buyers to be a bit more bullish on price when securing a home.

Demand isn’t going anywhere. Along with domestic housing needs, we continued to see an influx of new arrivals from overseas. Net migration in 2023 was over 500,000 people. While current forecasts are for this volume to be much lower in 2024, the final number is still likely to be well above the long-term average. These people are arriving in the middle of a rental crisis too, all of which feeds into price growth metrics.

Both increased transaction numbers and buyer confidence are feeding into current statistics as well. A recent report by the Australian Financial Review revealed auction clearance rates in the first full week of February hit their highest level in over 18 months, and their highest in Sydney in over two years.

A sub-section of the buyers pool that will be well worth watching this year are those high-net-worth individuals. These purchasers are often market leaders who are not dramatically affected by interest rate movements or cost-of-living issues. Our observation is that this purchaser group have, on the whole, increased their cash reserves throughout 2022 and 2023, and many are ready to invest. This might be in a trophy home (I would not be surprised if price records were broken in several location this year) or in prime commercial holdings. As such, assets with sound fundamentals and secure tenancies should trade well in 2024.

So, a look across this month’s submissions should be a cause for cautious optimism among property owners and industry stakeholders. Conditions heading into 2024 appear more favourable now that they were a few years back, and while none of our residential teams are predicting “boom” results, the consensus is that capital gains will return to a steady, long-term averages in most markets.

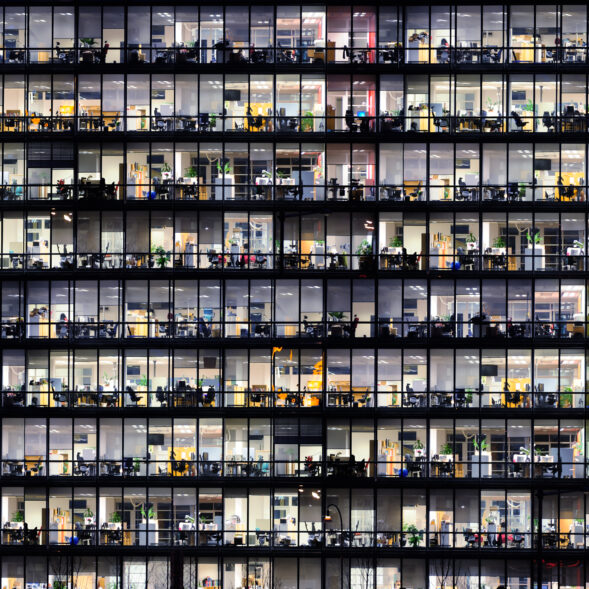

For readers interested in commercial real estate, our teams discuss the outlook for office markets in 2024. There continues to be challenges around the evolving workspace and flexibility arrangements – a highly relevant topic given the recent implementation of industrial relation legislation.

Finally, our rural valuers deliver their thoughts on the year ahead. After years of sustained growth across several primary industries, many believe this year might be one of consolidation and more muted outcomes. Of course, you’ll need to read their thoughts to gain a full appreciation of what may occur in rural during 2024.

Please enjoy our February 2024 edition on Month In Review.