Welcome to the April edition of Month in Review

The RBA’s April decision to pause interest rate increases is a significant development in the current market.

While there was disagreement among analysts as to whether the RBA would hold or increase, the consensus has been that we’re close to the peak of the rate rise cycle.

While some will speculate on the immediate fallout from the RBA’s move, I’m more interested in considering what it might mean for our property markets over the next three months or so.

I’m convinced we’re about to experience a significant transition in the residential property space in response to the rate pause for myriad reasons relating to supply and demand.

Supply – expressed as the number of listings – has been tight across our major population centres. Since early 2022, sellers have faced economic uncertainty and what looked like a long horizon of interest rates increases. As a result, a substantial number of would-be vendors shelved their plans, deciding to wait out the turmoil. This continued into this year with property listings now sitting around 20 per cent lower compared to this time last year. That’s narrowed the available pool for buyers substantially.

On the other side of the equation is demand. While some purchasers were buoyed into action by softer property prices in late 2022, most saw their borrowing power eroded by rising interest rates.

March 2023’s rate hike saw borrowers having to deal with a 50 per cent increase in their repayments compared to April 2022. Throw in the mandatory three per cent serviceability buffer factored into loan applications and the outcome is less available funds for borrowers.

The net result of the supply/demand imbalance has been market inactivity throughout most jurisdictions over the past 12 months. For example, transaction numbers in Sydney, our country’s largest property market, are down around 20 per cent on what they were 12 months ago.

This has also been reflected in ABS analysis which shows new loan commitments have been falling since January 2022 and are down around 30 per cent on what they were a year ago.

All this leads me to think this interest rate pause put us in the eye of the storm in terms of market activity.

I suspect we’ll see a material uplift in listings and transaction after Easter.

While increased listings will place downward pressure of property prices, other factors could help keep any softening to a minimum. For example, in several of this month’s submissions, our valuers have noted an uptick in tenants leaving the rental market and buying affordable housing and units.

The next three months will prove critical in establishing the long-term direction of our property markets. It will be crucial to stay abreast of the changes to capitalise on opportunities.

In this month’s edition of Month in Review, our residential valuers conduct a deep dive on the nation’s homebuying sector, identifying all the drivers and outcomes.

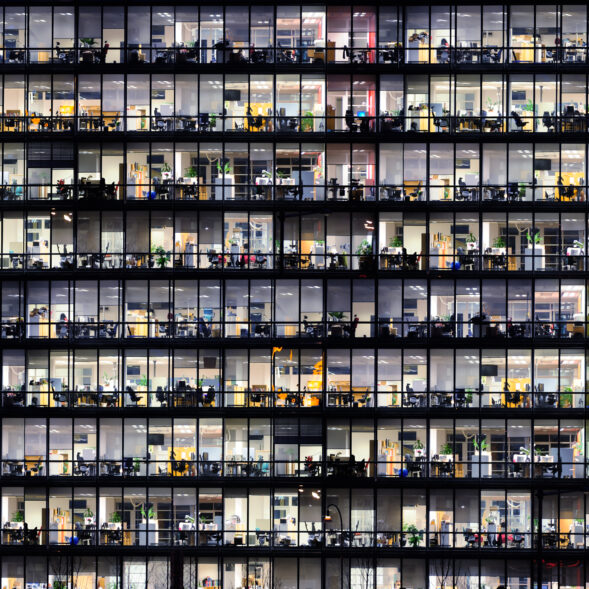

Meanwhile the commercial teams focus on a 2023 outlook for office property markets, while our rural specialists deliver another stellar overview of their markets with a focus on how advanced technology is affecting prices and production.

Please enjoy our April edition on Month In Review.

Gary Brinkworth

CEO